Every year, millions of Medicare beneficiaries miss out on hundreds-or even thousands-of dollars in savings because they don’t review their prescription drug coverage. It’s not that they don’t care; it’s that they don’t know where to start. The truth is, your Medicare plan changes every single year. Your insulin might move from a low-cost tier to a high-cost one. Your local pharmacy could drop out of the network. Your monthly premium could go up, even if your meds haven’t changed. If you’re still on the same plan you signed up for three years ago, you’re probably paying more than you need to.

Know When the Window Opens and Closes

Medicare’s Annual Open Enrollment Period (AEP) runs from October 15 to December 7 each year. That’s your only chance to switch plans for coverage that starts January 1. Miss it, and you’re stuck until next year-unless you qualify for a special enrollment period, which is rare. For 2026 coverage, the window is October 15, 2025, to December 7, 2025. Don’t wait until the last week. Plans update their formularies and networks in late October, and the Medicare Plan Finder tool gets flooded with users by mid-November. If you wait, you risk getting stuck with a plan that doesn’t cover your meds-or worse, one where your pharmacy isn’t in-network.

Start with Your Medication List

Before you even look at a plan, write down every medication you take. Include the name, dosage, and how often you take it. Don’t guess. Check your pill bottles or your pharmacy’s app. This isn’t optional. In 2024, 68% of Medicare beneficiaries who called the Medicare Rights Helpline needed help because they forgot to list a medication or got the dosage wrong. That mistake can cost you hundreds. For example, if you take Ozempic (semaglutide) at 1 mg weekly, and your plan only covers it at a higher tier if you’re on 2 mg, you’ll pay more. Same with insulin. The Inflation Reduction Act capped insulin at $35 per month in 2025-but only if your plan covers it. Some plans still don’t list it correctly.

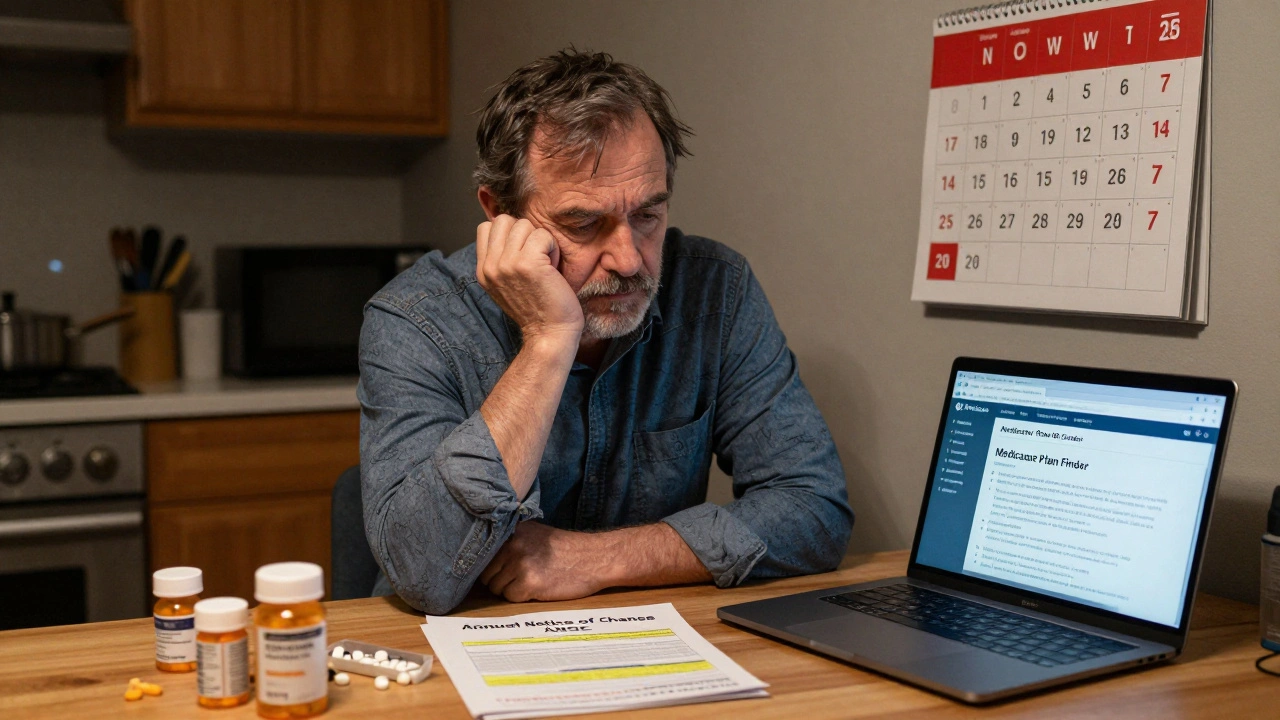

Get Your Annual Notice of Change (ANOC)

Your current plan is required to send you an ANOC by September 30. It’s a 6- to 10-page document that tells you exactly what’s changing for next year: premium increases, deductible changes, formulary shifts, and pharmacy network updates. Don’t ignore it. Read it. Highlight anything that affects your meds. If you didn’t get it, call your plan. Or log into your account on their website. Many people think, “My premiums didn’t change, so nothing else did.” That’s wrong. A drug you take could move from Tier 2 to Tier 4. That means your copay could jump from $20 to $120. In 2024, 60% of Part D plans changed at least one medication’s tier. That’s not rare. It’s normal.

Use the Medicare Plan Finder Tool

Go to Medicare.gov/plan-compare. Enter your zip code, your medications, and your preferred pharmacy. The tool shows you every plan available in your area. It doesn’t just show premiums. It shows your total estimated annual cost for your exact drugs. That’s the key. A plan with a $10 monthly premium might cost you $1,200 a year in drug costs. Another with a $40 premium might cost you $300. The tool calculates this for you. People who use it are 3.2 times more likely to find a cheaper plan than those who don’t. And it’s free. No sign-up. No sales pitch. Just facts.

Check Your Pharmacy Network

It’s not enough that your drug is covered. Is your pharmacy in-network? In 2024, 32% of Reddit users reported their pharmacy was removed from their plan’s preferred network. That means you pay more-sometimes double-for the same drug. If you use CVS, Walgreens, or your local independent pharmacy, verify they’re still in the plan’s network. Some plans have “preferred” pharmacies that charge less, and “standard” ones that charge more. If you can’t switch pharmacies, make sure your current one is still covered. And check if the plan offers mail-order options. For maintenance meds, mail order can cut your costs by 30% or more.

Watch for Formulary Tiers and Restrictions

Medicare drug plans group medications into tiers. Tier 1 is cheapest. Tier 5 is most expensive. Specialty drugs like those for MS, rheumatoid arthritis, or GLP-1s (like Wegovy or Mounjaro) often land in Tier 4 or 5. In 2024, 42% of plans increased cost-sharing on specialty drugs. That means your $50 copay could become $250. Some plans also require prior authorization or step therapy. That means you have to try a cheaper drug first-even if your doctor says it won’t work. Check your plan’s formulary for these restrictions. If your drug requires prior auth and you don’t want to jump through hoops, pick a plan that doesn’t require it.

Compare Medicare Advantage vs. Original Medicare + Part D

Most people don’t realize there are two main paths. Original Medicare (Parts A and B) plus a standalone Part D plan gives you freedom to see any doctor who accepts Medicare. But there’s no cap on out-of-pocket costs. If you have a bad year with expensive meds, you could pay thousands. Medicare Advantage (Part C) plans bundle Parts A, B, and usually D. They cap your out-of-pocket costs at $8,000 in 2025. But they often limit you to a network of doctors and hospitals. Only 43% of Medicare Advantage plans cover out-of-network care. If you travel a lot or see specialists outside your area, Original Medicare might be safer. If you’re mostly local and take several meds, Medicare Advantage might save you money. Use the Plan Finder to compare both options side by side.

Don’t Forget Supplemental Benefits

Many Medicare Advantage plans now offer extras: dental, vision, hearing aids, gym memberships, even transportation to appointments. But don’t be fooled. These benefits aren’t always free. Some require you to meet income limits. Others are only available if you’re enrolled in a specific plan type. Dual-eligible beneficiaries (those with both Medicare and Medicaid) need to be especially careful. In 2024, 31% of Advantage plans had hidden restrictions on supplemental benefits that weren’t visible in the Plan Finder. If you need hearing aids or transportation, ask the plan directly-don’t assume.

What If You’re Not Sure?

You’re not alone. In 2024, 68% of Medicare beneficiaries needed help during open enrollment. That’s why the State Health Insurance Assistance Program (SHIP) exists. Every state has free, certified counselors who help you compare plans. No sales pitch. No pressure. Just guidance. Find your local SHIP office at shiptacenter.org. They can walk you through your ANOC, explain formulary tiers, and even help you submit your enrollment. The average person spends 3.7 hours on this process. With help, it takes less than half that time.

Common Mistakes to Avoid

- Waiting until December to start. The tool slows down. You risk missing the deadline.

- Assuming your current plan is still the best. Plans change every year. Yours probably isn’t.

- Ignoring pharmacy changes. Your local store might not be in-network anymore.

- Forgetting to list all your meds. Even one missed drug can throw off your cost estimate.

- Not checking for prior auth or step therapy. You might get denied coverage mid-year.

What Happens After You Enroll?

Once you pick a plan and submit your change by December 7, your new coverage starts January 1. You’ll get a new ID card in the mail. Don’t throw out your old one until you get it. Keep your current plan active until then. Also, your new plan might not cover your meds right away. Some have a 30-day waiting period for new enrollees. Call the pharmacy to confirm your drugs are covered before you refill. If you’re switching from Original Medicare to Medicare Advantage, your doctor’s office may need to update their records. Call them too.

Why This Matters

In 2025, the Inflation Reduction Act fully closed the Part D coverage gap-the so-called “donut hole.” That’s good news. But it doesn’t mean everything is cheaper. Premiums are rising slightly. Specialty drugs are getting more expensive. And plans are still shifting formularies. The average beneficiary who reviews their plan saves $532 a year on prescriptions alone. Some save over $1,200. That’s not a small amount. That’s groceries. That’s gas. That’s paying for a co-pay on your heart medication. You don’t need to be an expert. You just need to take 4 hours in October. Gather your meds. Read your ANOC. Use the Plan Finder. Call SHIP if you’re stuck. You’ve earned this. Don’t let a bureaucratic system cost you more than you have to.

Can I change my Medicare drug plan after December 7?

No, you can’t change your Part D or Medicare Advantage plan after December 7 unless you qualify for a Special Enrollment Period. These are rare and usually only apply if you move out of your plan’s service area, lose other coverage, or qualify for Extra Help (low-income subsidies). If you miss the deadline, you’ll be stuck with your current plan until next year’s Open Enrollment Period.

What if my medication isn’t covered by any plan?

If none of the plans in your area cover one of your medications, you can request an exception. Your doctor must submit a form explaining why the drug is medically necessary and why alternatives won’t work. Most plans approve these requests if you have documentation. If denied, you can appeal. You can also ask your doctor about generic alternatives or patient assistance programs from drug manufacturers. Some companies offer free or discounted meds to Medicare beneficiaries who meet income requirements.

Do I need to re-enroll every year?

No, you don’t have to re-enroll unless you want to change plans. If you do nothing, you’ll automatically stay in your current plan for the next year. But that doesn’t mean it’s the best deal. Plans change every year-premiums, formularies, networks. Staying put without checking could cost you hundreds more than switching.

How do I know if my plan covers my insulin at $35?

All Medicare Part D plans must cap insulin at $35 per prescription in 2025. But only if the insulin is on the plan’s formulary. Check the plan’s drug list to confirm your specific brand (like Humalog, Lantus, or NovoLog) is covered. Some plans still have restrictions, like requiring you to use mail order or limiting the number of pens per month. Always verify coverage before switching.

Can I switch from Medicare Advantage back to Original Medicare during Open Enrollment?

Yes. During the Annual Open Enrollment Period (October 15-December 7), you can switch from a Medicare Advantage plan back to Original Medicare (Parts A and B). You can also enroll in a standalone Part D plan at the same time. Just make sure you do both together-switching to Original Medicare without adding Part D could leave you without drug coverage and trigger a late enrollment penalty.

Michael Gardner

12 Dec 2025 at 19:20Yeah right, like anyone actually reads that ANOC document. My grandma threw hers out thinking it was junk mail. Then she got stuck paying $180 for her insulin because the plan ‘forgot’ to list it as covered. Don’t blame the system-blame the people who think ‘automatic renewal’ means ‘no thinking required.’